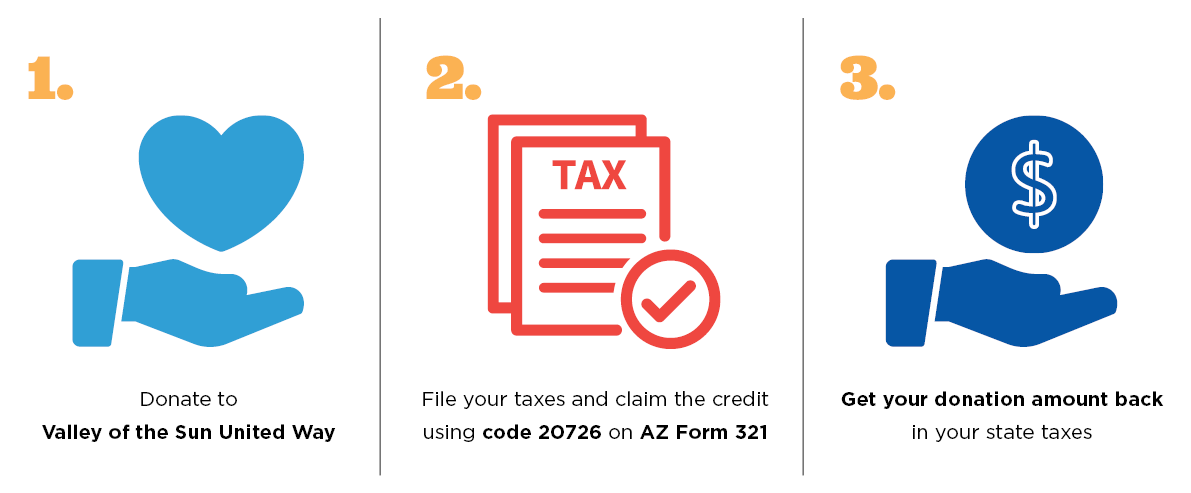

When you donate to Valley of the Sun United Way through the Arizona Charitable Tax Credit, you can get your donation amount back in your state taxes without needing to itemize your return!

The maximum credit donation amount for 2023:

$421 single, married filing separate or head of household; $841 married filing joint.*

The maximum credit donation amount for 2024:

$470 single, married filing separate or head of household; $938 married filing joint.*

*Arizona law allows certain tax credit donations made during 2023 or donations made from January 1, 2024 through April 15, 2024 to be claimed on the 2023 Arizona income tax return. If a taxpayer makes a donation from January 1, 2024 through April 15, 2024 and wants to claim the higher 2024 maximum credit amount, the taxpayer will need to claim the credit on the 2024 Arizona return filed in 2025. Please note that Valley of the Sun United Way is not a tax advisor, and as with any financial recommendation, contact a qualified tax professional for advice on your specific tax situation.

Your $100 donation provides mentorship for three students to find education and employment opportunities.

Your $421 donation provides up to 2,000 meals for individuals facing food insecurity.

Your $841 donation provides one month of emergency shelter for a family of three.

“It’s like being reimbursed for doing something good for our neighbors in need.” – Elizabeth L, Valley of the Sun United Way donor

Tax credits provide a dollar-for-dollar reduction of your income tax liability. Tax deductions lower your taxable income and are equal to a percentage of your marginal tax bracket. You cannot claim both a deduction and a credit for the same charitable contribution on your Arizona return.

Taxpayers do not have to itemize deductions to claim a credit for contributions to Qualifying Charitable Organizations (QCOs).

Arizona law makes available a Credit for Contributions to QCOs for cash contributions to a QCO or an Umbrella Charitable Organization (UCO). A UCO is a charitable organization that collects donations on behalf of QCOs. Valley of the Sun United Way collects these contributions through its Arizona Charitable Tax Credit fund, and 100% of contributions to that fund are distributed to QCOs. To take advantage of this benefit with your donation to Valley of the Sun United Way, you must direct a portion of your gift – $421 for individuals and $841 for couples filing jointly in 2023 or $470 for individuals and $938 for couples filing jointly in 2024 – to Valley of the Sun United Way’s Arizona Charitable Tax Credit designation.

To take advantage of this benefit with your donation to Valley of the Sun United Way, you must direct a portion of your gift – $421 for individuals and $841 for couples filing jointly in 2023 or $470 for individuals and $938 for couples filing jointly in 2024 – to Valley of the Sun United Way’s Arizona Charitable Tax Credit designation.'

The deadline for making a charitable contribution for the 2023 tax year is April 15, 2024.