Taxes can be complicated, but supporting your community doesn’t have to be. Arizona taxpayers have a unique opportunity to donate to qualifying charities and get that donation amount back when they file their taxes. Is there a charity you’ve been eager to support but aren’t ready to make a financial commitment just yet? Are you looking for a way to increase your contribution to the community while decreasing your tax liability? The Arizona Charitable Tax Credit may be the answer!

Valley of the Sun United Way relies on charitable donations to continue to fund critical programs in our community, all of which focus on tackling today’s most pressing issues, including health and hunger, housing and homelessness, education and workforce development. All integral parts of MC2026, a five-year plan for Mighty Change in Maricopa County.

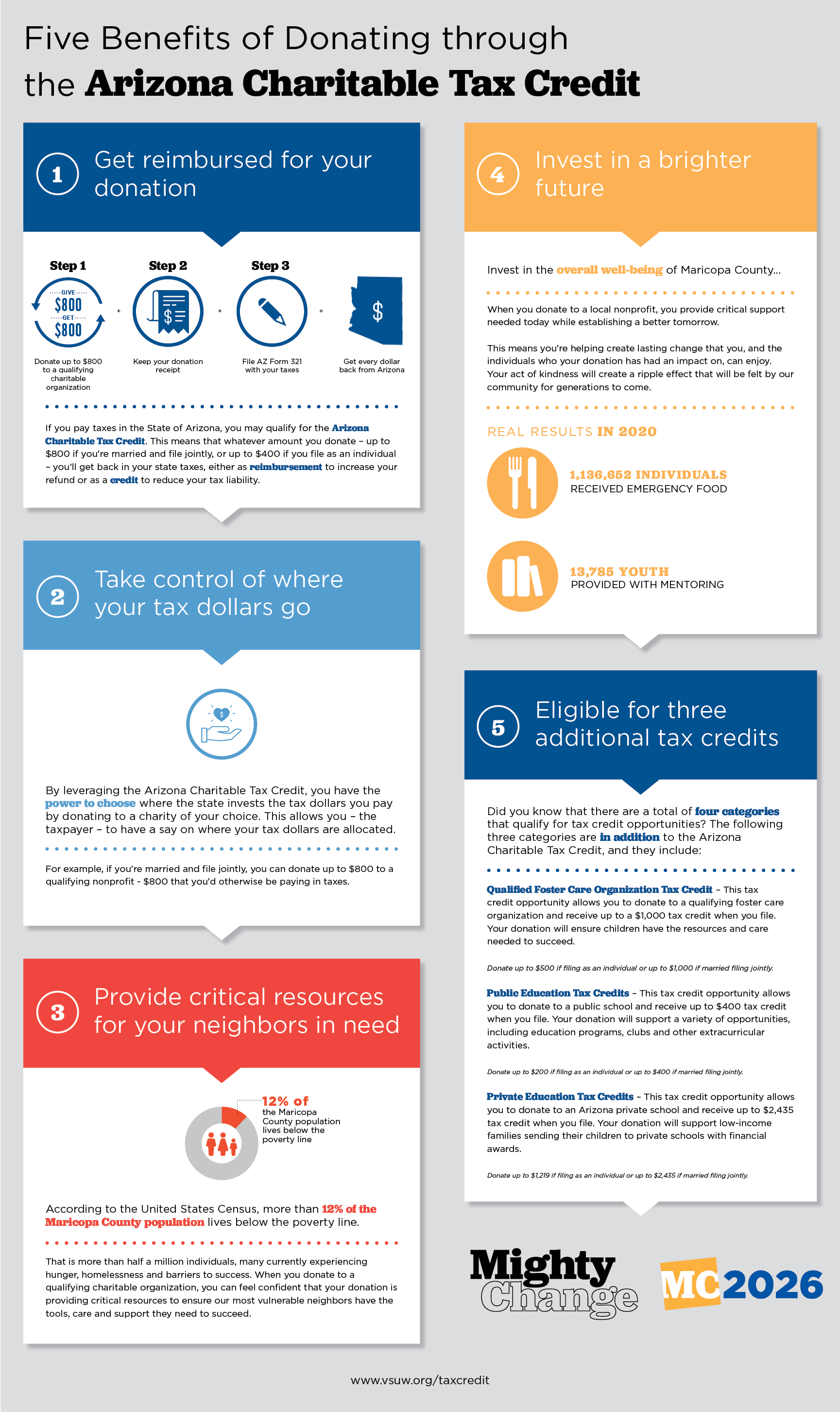

There are numerous benefits to donating to your favorite local charity through the Arizona Charitable Tax Credit. If you’ve never done it before, don’t worry, it’s never too late to make a difference in your community – and your state taxes!

If you pay taxes in the State of Arizona, you may qualify for the Arizona Charitable Tax Credit. This means that whatever amount you donate – up to $800 if you’re married and file jointly, or up to $400 if you file as an individual – you’ll get back in your state taxes, either as reimbursement to increase your refund or as a credit to reduce your tax liability. So technically, your donation doesn’t cost a thing!

Taxes are inevitable. Fortunately, the State of Arizona allows taxpayers to have a say on where some of those dollars go. By leveraging the Arizona Charitable Tax Credit, you have the power to choose where the state invests the tax dollars you pay by donating to a charity of your choice. This allows you – the taxpayer – to have a say on where your tax dollars are allocated.

For example, if you’re married and file jointly, you can donate up to $800 to a qualifying nonprofit - $800 that you’d otherwise be paying in taxes.

According to the United States Census, more than 12% of the Maricopa County population lives below the poverty line. That is more than half a million individuals, many currently experiencing hunger, homelessness and barriers to success. When you donate to a qualifying charitable organization, you can feel confident that your donation is providing critical resources to ensure our most vulnerable neighbors have the tools, care and support they need to succeed.

When you donate to a local nonprofit, you provide critical support needed today while establishing a better tomorrow. By giving back to your community, you’re investing in the overall wellbeing of Maricopa County. This means you’re helping create lasting change that you, and the individuals who your donation has had an impact on, can enjoy. Your act of kindness will create a ripple effect that will be felt by our community for generations to come.

Did you know that there are a total of four categories that qualify for tax credit opportunities? The following three categories are in addition to Arizona Charitable Tax Credit, and they include:

Donate up to $500 if filing as an individual or up to $1,000 if married filing jointly.

Donate up to $200 if filing as an individual or up to $400 if married filing jointly.

Donate up to $1,219 if filing as an individual or up to $2,435 if married filing jointly.

As you prepare to file your taxes, please consider giving to a local charity and leveraging the Arizona Charitable Tax Credit. You’ll feel proud to know that you made a difference in the lives of your neighbors in need with money that would have otherwise been allocated at the discretion of the state.

Please include attribution to www.vsuw.org with this graphic.

<p><strong>Please include attribution to www.vsuw.org with this graphic.</strong><br /><br /><a href='https://vsuw.org/blog/five-ben...'><img src='https://vsuw.org/blog/five-ben...' alt='AZ Tax Credit | Five Benefits' width='1729' border='0' /></a></p>

To learn about the work Valley of the Sun United Way is doing to create Mighty Change in Maricopa County, click here. If you’d like to donate to Valley of the Sun United Way and get a dollar-for-dollar tax credit, make a donation (up to $800) and use code 20726 on AZ Form 321 when you file your taxes.

*Arizona State tax credits are available based on your income tax filing status. Valley of the Sun United Way is not a tax advisor. As with any financial recommendation, contact a qualified tax professional for expert advice on your specific tax situation.